When you pick up a prescription at the pharmacy, you probably don’t think about who made it or how much it cost to produce. But behind every pill, there’s a story of labor, regulation, and economics. And that story looks completely different depending on whether the drug is a brand-name product or a generic version.

Generic drugs make up 90% of all prescriptions filled in the U.S. Yet, they account for less than 20% of total drug spending. How is that possible? The answer lies in labor costs - and how they’re structured differently between brand-name and generic manufacturers.

Why Generic Drugs Cost So Much Less

Generic drugs aren’t cheaper because they’re made from cheaper ingredients. The active pharmaceutical ingredient (API) in a generic drug is chemically identical to the brand-name version. The real savings come from how those drugs are made - especially in terms of labor.

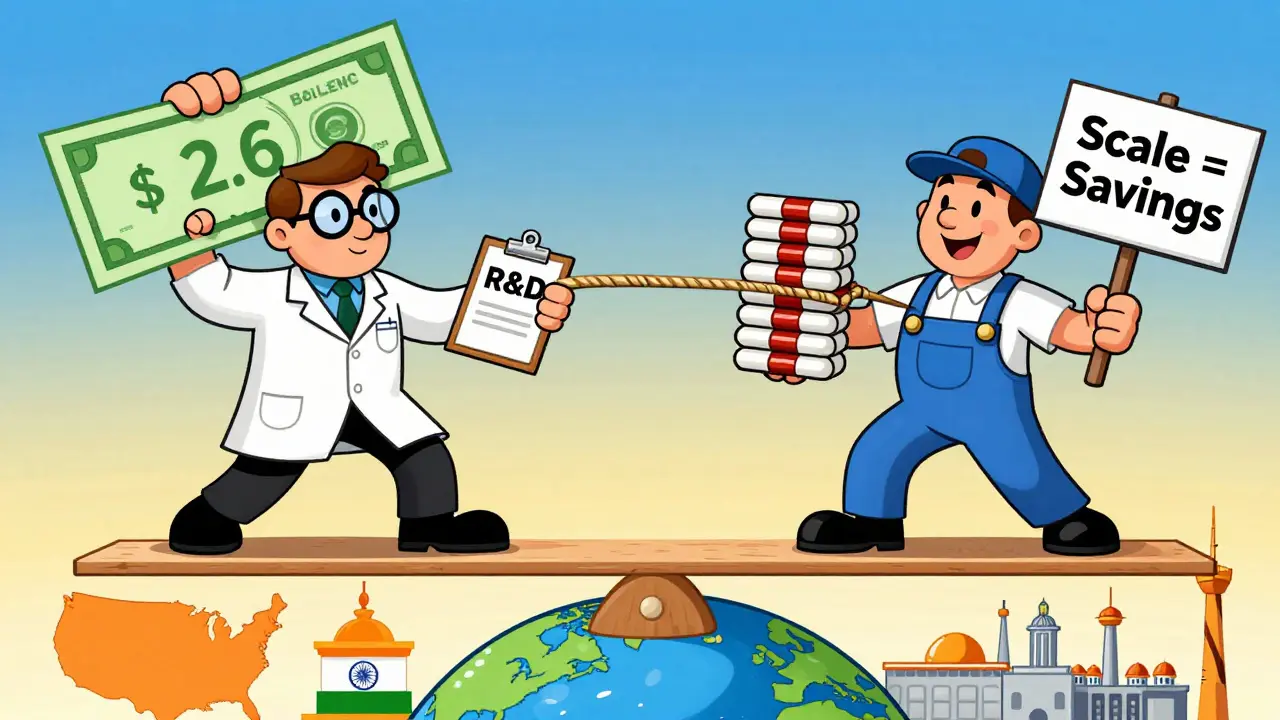

For brand-name drugs, labor is a major expense. Developing a new drug takes 10 to 15 years and costs about $2.6 billion on average. That money goes to scientists, clinical trials, regulatory filings, patent lawyers, and marketing teams. Even after approval, the labor burden doesn’t stop. Brand manufacturers maintain small, highly skilled teams to manage complex production processes, handle strict quality controls, and respond to regulatory audits.

Generic manufacturers don’t have to do any of that. They don’t need to prove safety or efficacy - the FDA already accepted those claims when the brand-name drug was approved. So their labor doesn’t go into research. It goes into making the same thing, over and over, as efficiently as possible.

Labor Cost Breakdown: Brand vs Generic

Here’s how labor stacks up:

- Brand-name drugs: Labor makes up 30% to 40% of total manufacturing costs during early production. This includes R&D staff, quality assurance specialists, regulatory compliance officers, and production supervisors.

- Generic drugs: Labor accounts for only 15% to 25% of costs. Why? Because they’re produced at massive scale, with streamlined processes and fewer regulatory hurdles.

One key difference is volume. A single generic drug factory might produce 100 million pills per month. That kind of scale means workers can focus on repetitive tasks - filling bottles, labeling, packaging - with minimal supervision. Machines do most of the heavy lifting. A single operator can manage multiple production lines. In contrast, brand-name production often runs smaller batches, with more manual checks and frequent equipment cleanings.

BCG’s 2019 study found that generic manufacturers cut unit costs by 27% every time production volume doubles. Brand manufacturers only saw a 17% drop. That’s because generics benefit from what economists call economies of scale. More output = less labor per unit.

Quality Control: The Hidden Labor Cost

Don’t be fooled - generic drugs aren’t made by untrained workers in garages. In fact, quality control (QC) is one of the biggest labor expenses in generic production.

Every batch of generic drugs must be tested for purity, potency, and stability. Raw materials are checked. In-process samples are analyzed. Final products are inspected under strict FDA guidelines. All of this requires trained technicians, lab analysts, and documentation specialists.

According to DrugPatentWatch, QC alone accounts for over 20% of total generic drug production costs. That includes:

- Testing raw materials (labor-intensive lab work)

- Running in-process checks during manufacturing

- Final product validation

- Batch record documentation (paperwork that can take hours per batch)

For a medium-sized generic company with 20 to 500 employees, just maintaining compliance systems costs about $184,000 per year. Add in FDA program fees and new drug applications, and you’re looking at over $2 million annually in labor-related compliance costs.

So while generics avoid R&D expenses, they still need skilled labor - just in different places.

Where the Drugs Are Made Matters

Most API - the active ingredient - for generic drugs is made overseas. About 80% of global API production happens in India and China. Why? Labor costs there are 42% lower than in the U.S., according to Prosperous America’s 2023 analysis.

But here’s the catch: those lower costs don’t mean those factories are more efficient. The HHS Office of the Assistant Secretary for Planning and Evaluation found that international production advantages come from:

- Lower wages

- Weaker environmental regulations

- Government subsidies

- Massive scale

That means when you buy a generic drug made in India, you’re not just getting a cheaper product - you’re benefiting from a global labor imbalance. A worker in a U.S. QC lab might earn $65,000 a year. In India, the same role pays $12,000.

This creates tension. As U.S. regulators push for more domestic production to reduce supply chain risks, companies face pressure to bring manufacturing home. But that could raise labor costs - and ultimately, drug prices.

Contract Manufacturing: The New Normal

Many generic manufacturers don’t own factories anymore. Instead, they outsource production to Contract Manufacturing Organizations (CMOs). In fact, biosimilar producers spend 42% of their cost of goods sold on CMOs - compared to just 28% for traditional generic makers.

This shift changes how labor costs work. Instead of paying fixed salaries to in-house staff, companies pay per batch. That gives them flexibility: when demand spikes, they can order more. When demand drops, they scale back. It’s like hiring freelancers instead of full-time employees.

But this also means less job security for workers. CMOs often operate on thin margins, which can lead to understaffing, rushed production, or skipped inspections - all of which risk quality.

Why Prices Keep Dropping - And Why That’s a Problem

Every time a new generic enters the market, prices drop. The FDA found that when just three generics compete, prices fall below the brand-name price. With five or more, prices can plunge by 80% to 90%.

But here’s the hidden cost: that pressure forces manufacturers to cut labor wherever they can. That means:

- Reducing QC staff

- Slowing training programs

- Delaying equipment upgrades

- Increasing automation without skilled oversight

The FDA warned in 2023 that this race to the bottom could lead to drug shortages. If a factory cuts too many workers, a single equipment failure or contamination event can shut down production for months. And with generics making up 9 out of 10 prescriptions, that affects millions of patients.

Who Really Pays the Price?

Consumers pay less upfront for generics. But if labor cuts lead to quality issues or supply shortages, the real cost shows up later - in delayed treatments, emergency room visits, or switching to more expensive brand-name drugs.

Meanwhile, brand-name manufacturers aren’t just charging more because they’re greedy. They’re recovering massive R&D investments. But they’re also protected by patent extensions and settlement deals with generic companies. These deals delay competition, keeping prices high for longer.

So while generic drugs are undeniably cheaper, the labor cost difference isn’t just about wages. It’s about:

- Scale

- Regulation

- Geography

- Market competition

And all of these factors are under pressure.

What’s Next?

The future of generic drug production is uncertain. More countries are pushing for local manufacturing. The U.S. government is funding domestic API production. But that could raise costs - and prices.

On the other hand, automation and AI are making QC faster and cheaper. Robots can now test samples with near-perfect accuracy. That could reduce labor needs without sacrificing quality.

One thing is clear: the gap between brand and generic labor costs isn’t going away. But how we manage it - and whether we prioritize cheap drugs over reliable supply - will shape healthcare for decades.

Why are generic drugs so much cheaper than brand-name drugs?

Generic drugs are cheaper because they don’t need to repeat expensive clinical trials or pay for brand marketing. Their main costs are manufacturing and compliance. Labor costs are lower due to massive production scale, simplified processes, and outsourcing to low-wage countries. Brand-name drugs, by contrast, must recoup $2.6 billion in R&D costs per drug, which includes years of research, testing, and regulatory work - all of which require high-skill labor.

Do generic drugs use lower-quality labor?

No - but they often use labor differently. Generic manufacturers rely on highly trained QC technicians and lab analysts to meet FDA standards. The difference is volume: one worker can oversee dozens of production lines because the processes are standardized. Brand-name manufacturers use more specialized, smaller teams focused on innovation and complex formulations. Neither is “lower quality,” but the structure of work is very different.

Is it true that most generic drugs are made in India and China?

Yes. About 80% of active pharmaceutical ingredients (API) for generic drugs are produced in India and China. Labor costs there are roughly 42% lower than in the U.S., and production scale is massive. While this keeps prices low, it also creates supply chain risks - as seen during the pandemic when global shipments were disrupted.

Why do generic drug prices keep falling even when demand stays the same?

Because competition increases. Every time a new generic company enters the market, prices drop. With just three competitors, prices fall below the brand. With five or more, they can drop by 80-90%. Manufacturers compete by cutting costs - including labor - to stay profitable. This creates pressure to reduce staffing, automate, or outsource further, which can threaten quality if not managed carefully.

Can cheaper labor lead to drug shortages?

Yes. When manufacturers cut too many workers or reduce training to save money, they become vulnerable to errors. A single contamination, equipment failure, or documentation mistake can shut down a production line. With generics making up 90% of prescriptions, even a short shutdown affects millions. The FDA has warned that cost-cutting in labor-intensive areas like quality control is a leading cause of drug shortages.